- Posted by: Andre Misrole

- Category: Uncategorised

Because of the havoc, Covid19 has caused on South African household economies, it has forced many consumers to seek financial aid, especially with their debt which has now become unmanageable because some households have lost literally 50% of their income due to retrenchment.

There are sadly many negative effects that Covid19 and the national lockdown has had, and it has most certainly affected all of us… Some, more than others.

I can go on for hours talking about the devastating effects of Covid19 from both an economic perspective and even more importantly from a personal perspective where so many families are losing loved ones daily.

This post is about how you need to go about when choosing a ‘Debt Counsellor’ who is competent and more importantly, whom you can entrust to have your best interests at heart by giving you the much-needed relief during this challenging time. Probably even more importantly, to help you not lose the assets you’ve worked so hard over the years to keep.

So what do you do exactly and where do you even start..??

Step #1 – Visit the NCR (National Credit Regulator) website for important information to confirm that they’re verified and registered

Your first step is to go to the NCR (National Credit Regulator) website at www.ncr.org.za then click on the fourth tab on the top of the page that says ‘Registrants’. A drop-down menu will appear, then click on ‘Debt Counsellors’. Why this step is important is because you will find a list of currently active ‘Debt Counsellors’ on the system. There are currently roughly 1719 active ‘Debt Counsellors’ registered with the NCR as of writing this post on the 28’th of July 2021.

So this already gives you peace of mind that the ‘Debt Counsellor’ you’re looking to work with, is in fact still in business. This may come as a surprise to you, but there are many ‘Debt Counsellors’ who are no longer in business for many reasons. More importantly one’s whom the NCR have revoked and de-registered from trading due to being non-compliant. Many of the non-compliant ‘Debt Counsellors’ are often the ones who cause more problems for consumers than they solved if they solved any at all…

Step #2 – Search for your Debt Counsellor of choice

Now that you’re on the ‘Registrants’ page, you can search for the ‘Debt Counsellor’ you want to work with…

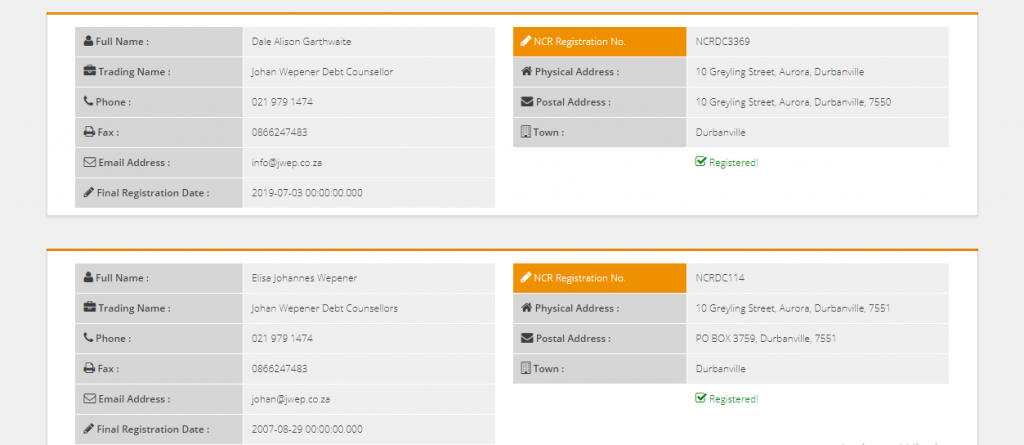

If you know the name you just type it into the search bar and it will appear… E.g. if you type in Johan Wepener, which is my strategic partner here at Exonerate, you will see all of his credentials come up as shown below. The one key credential you need to look for when choosing a ‘Debt Counsellor’ is their NCRDC (National Credit Regulator Debt Counsellor) registration number.

In the screenshot below are our credentials, including the names of the two ‘Debt Counsellors’ Dale Alison Garthwaite and Elisa Johannes Wepener, who do the all-important administration such as registering, renegotiating and restructuring contracts on our client’s accounts and behalf.

If you’re not sure who you want to work with, you could also do an area search, e.g. if you live in the Helderberg, you could type in ‘Somerset West’, after which the search will then display all of the current registered ‘Debt Counsellors’ in the Somerset West area.

This is quite useful because it’s always good to work with a ‘Debt Counsellor’ nearby for obvious reasons.

Ste[ #3 – Review their website and social media accounts

Now that you’ve found an NCR registered, active ‘Debt Counsellor’, it’s time to take your research a step further…

You will want to take a look at their website, and more importantly their social media. I don’t care who says what, but you can tell a lot about a company and how they treat their clients, purely by looking at how they engage and treat their community on their social media platforms. At the end of the day, it all boils down to culture.

(Just for the record, our social media isn’t perfect in case you’re wondering, but we make a concerted effort to engage with everyone, at every opportunity we get!!)

You want to see the comments and the types of responses the company gives to people who comment or ask questions looking for clarity.

Look at the tone or manner in which the company engages and, importantly, the time it takes to respond to a query or comment from an interested consumer. This will largely give you an indication of how you will be treated if you decide to work with that company and become one of their clients.

Quality of content is also important. Try and figure out if they’re creating their own content or just regurgitating someone else’s. This is lazy marketing and if they’re lazy in their marketing, yep, you guessed it, they’re pretty much lazy in some of their other processes too. The quality of the content can also be an indication of their competence or level of expertise in their industry!

Probably the most important aspect you will want to look for on social media is their reviews. What are people saying about the company? There really is no feedback like that of an existing or past client. Reviews are always a winner and are probably largely what you need to base your decision on. However… Be very careful with this one because many companies put up fake reviews just to attract and lure in potential clients. So you have to be vigilant and wise with this one. E.g. if all you’re seeing are 5 start reviews (which is BS by the way because everybody knows that even the biggest businesses and brands in the world get it wrong sometimes) but their posts and engagement don’t speak to the reviews they’re posting. You know they’re up to no good!!

Step #4 – Are they, specialists

This step may be a bit confusing because arent all registered ‘Debt Counsellors’ supposed to be specialists in their field or industry? Uhmmm… No!!

Here’s why I say so…

Look at the medical industry as an example… You get many types of doctors but all who specialise in certain areas. You get general practitioners, obstetricians and gynaecologists, psychiatrists, dentists, dermatologists and the different types of surgeons. All are qualified doctors, but not qualified to deal with the various functions of the human anatomy.

So what’s my point?

Just like doctors, it’s the general practitioners you want to avoid when researching a ‘Debt Counsellor’. There are many registered ‘Debt Counsellors’ who also happen to be registered attorneys, accountants or general businessmen and women for that matter. Now, this doesn’t mean they don’t know what they’re doing, because they simply just wanted to upskill themselves and add more artillery to their arsenal. Which in most cases are a good thing and I’m sure they’re pretty good at what they do.

But, ARE THEY GOING TO BE GOOD FOR YOU??

I guess what I’m trying to say is that you don’t want to be working with a ‘Debt Counsellor’ who is an attorney and runs a successful practice. Attorney work is extremely admin intensive and they also have to appear in court, just like a huge part of the ‘Debt Counselling’ process is, but you don’t want to be put on the sidelines or not made a priority when you have pressing matters at hand. Especially if you’re already or going to be behind on your payment with your car or bond.

So make sure that you’re going to be a priority and that you choose a company that only specialises in primarily, debt management if that makes sense.

Step #5 – Have a consultation with them or try and set up a meeting in person

I know Covid19 has made it challenging to do business as usual, and from a health perspective, it’s probably best to not meet in person. However, if you can’t meet in person, at least set up a meeting or consultation over the phone.

This is a great way to write down and ask some questions you may have. You will pick up almost immediately what kind of service you will be dealt with. From a competency perspective to all-around customer service. often our gut feelings warn us of certain people, this is true in business too. So be sure to walk away if you don’t have a good feeling after the meeting or telephonic consultation.

So be sure to call a couple of debt counsellors if you’re not sure who to work with and I have no doubt that you’ll find one who resonates with you in no time who will help give you the breathing room you so desperately need. More importantly, protect you from legal action and losing your assets to creditors.

Now that you have your 5 steps to potentially eliminate some important red flags, you are 90% on your way to making a good financial decision for yourself and your loved ones.

Now you may be thinking “Andre, why only 90% and not 100%?” Well, the truth is, you can do all the research in the world and ensure you have all the facts, numbers and statistics, but sometimes we just make the wrong choices in life, and that’s okay. What’s important to know is that if you’ve made a bad choice in choosing a ‘Debt Counsellor’ who isn’t giving you the service you thought you’d get and more importantly deserve, you can always transfer to another one who can give you the service you not only pay for but actually deserve.

You can read more on transferring to another DC in my post ‘Can I change or transfer to another ‘Debt Counsellor?’

Thank you for taking the time to read this post… I sincerely hope you found it helpful and that it enabled you to make a wise choice.

I always love to hear from our community members, so please be sure to leave a comment or reach out to us via email with any questions or queries you may have.

To your financial independence.

Andre Misrole

Founder